Investment or payment of 2023 profit-sharing bonuses

The 2024 employee savings campaign for the choice of investment or payment of profit-sharing and participation bonuses takes place from May 22 to June 5, 2024 inclusive.

The choice will be made on the AMUNDI website using your personal identifiers.

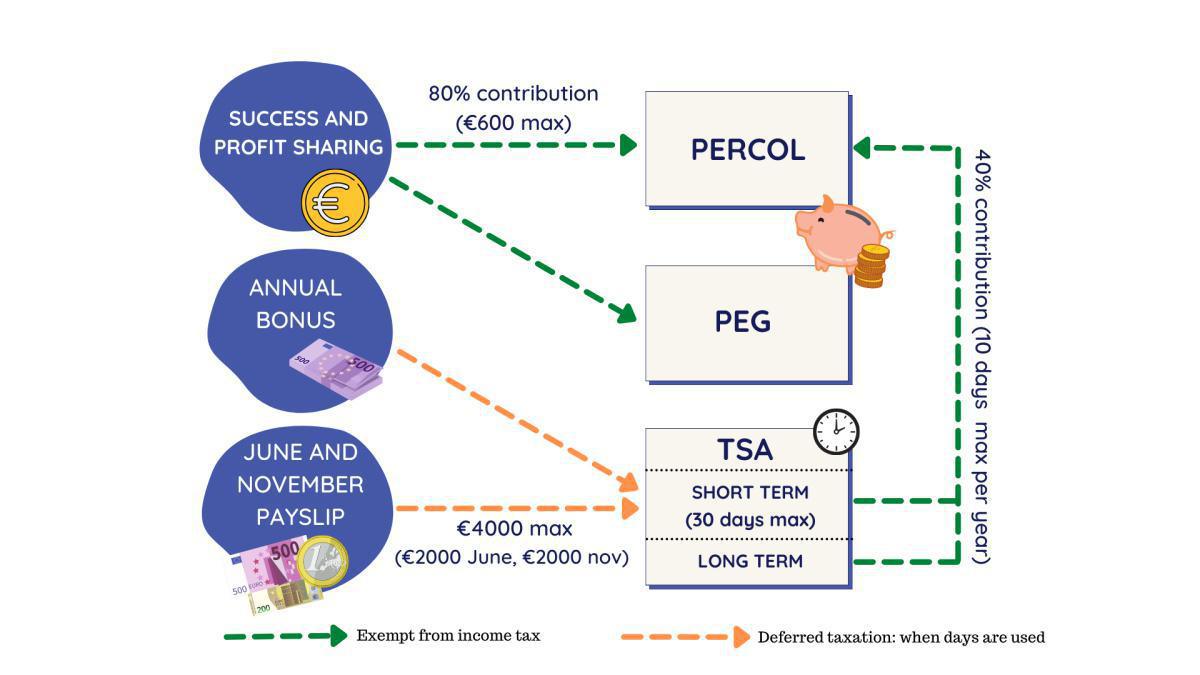

By default and without choice on the site, the profit-sharing will be paid 100% on the PEG (Group Savings Plan) and the participation will be paid 50% on the PERCOL (Collective Retirement Savings Plan) and 50% on the PEG.

The main advantage of investing these bonuses is to avoid income tax (except CSG and CRDS social charges of 9.7%) in return for a blocking period of 5 years on the PEG and until retirement on the PERCOL.

In addition, during the negotiations of the new AIrbus social status, FO obtained the doubling of the contribution for voluntary payments on the PERCOL, going from 40% to 80%, with a ceiling unchanged at €600 gross.

Thus, the payment of €750 gross (i.e. €677.25 net after deduction of 9.7% CSG/CRDS) makes it possible to obtain the ceiling of €600 gross contribution (i.e. €541.8 net after deduction of 9.7% of CSG/CRDS).

Transfer of days from TSA Short Term (ST) or Long Term (LT) to PERCOL

Until June 10, you can place up to 10 days max of TSA ST or LT to PERCOL.

The main interest is to exempt from income tax the sums resulting from the monetization of these days, in return for the duration of blocking of funds until retirement (remaining 9.7% of CSG/CRDS and reduced social tax).

In addition, these obtained amounts are increased by 40% up to a maximum of 16% of the annual social security ceiling (i.e. €7,418 gross for 2024).

This contribution is added to that of €600 gross on voluntary investments in the PERCOL

This placement is carried out on the Hub on myHR, Services tab, Administrative Services/Services Request/Transfer of TSA days to PERCOL.

We recommend making this investment during the voluntary end-of-year investment campaign (end of November) after the application of the 2024 salary campaign.

Monetary investment in TSA

Until June 10, 2024, you have the possibility of making a voluntary investment of €60 to €2000, by deduction from June salary, in order to generate days on the TSA ST.

It is also possible to make a monetary investment in TSA of €60 to €2000, by deduction from November salary until November 14, 2024.

During the negotiations of the new AIrbus social status, FO obtained the possibility of making 2 monetary investments in TSA of up to €2,000 gross each, in order to compensate for the impossibility of using the seniority bonus, now monthly paid since January 1, 2024.

These voluntary investments are made on the Hub, on myHR, Services tab/Administrative Services/Services Request/Monetary investment in TSA.

As a reminder, the maximum number of days on the TSA ST is capped at 30 days. The number of days transferable from TSA ST to LT is 40 days exceptionally in 2024, then 30 days / year.

For more information on employee savings plan and TSA, please refer to the FO electronic booklet on the new Airbus social status.

https://fo-airbus.fr/project/nouvel-accord-societe-airbus-group/

FO, the union which defends your interests