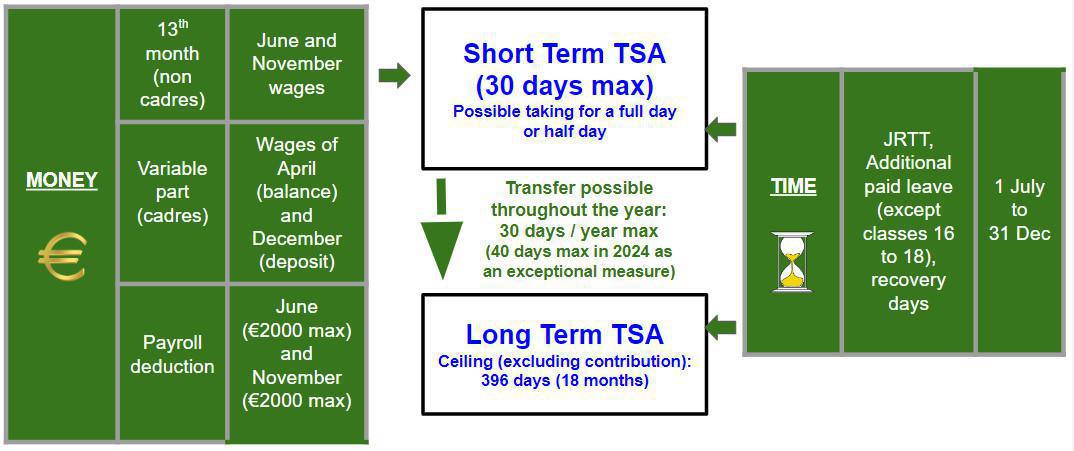

Short Term TSA

The Short Term TSA is capped at 30 days at any time of the year.

However, this does not prevent you from feeding this account with more than 30 days during the same year! Indeed, as soon as days placed on the Short Term TSA are either used as holidays, or paid, or transferred to the Long Term TSA, you can reach again the 30 days ceiling.

Example: you have 20 days on your Short Term TSA. You therefore have a maximum of 10 days left to put in before reaching the 30-day ceiling. If you decide to transfer the 20 days from the Short Term TSA to the Long Term TSA, then you can place up to 30 days there again.

Long Term TSA

The Long Term TSA is capped at 396 days (excluding contributions), which corresponds to approximately 18 months.

The contribution* is 1/3 (33.33%), the maximum contribution is therefore 132 days (396 * 1/3), which represents 6 additional months.

Please note: on the myHR Long Term TSA counter, you do not see the contribution but only the number of days that you have placed throughout your career.

What are the contribution rules?

-When the Long Term TSA is used just before retirement (this is the most common case), the contribution is granted if the departure date occurs before the full rate date, or on the full rate date at the latest. In the event of departure beyond the full rate date, the period before it is supplemented, but not the period after.

Example for an employee with 200 days of Long Term TSA whose full rate date is 01/07/2028:

- In the event of retirement before 07/01/2028, or on 07/01/2028 at the latest, he benefits from a 66-day contribution (200 * 1/3) => he will stop his activity 266 days before his retirement date (or even earlier if he chooses an additional measure such as the conversion of his retirement bonus into days of inactivity)

- In the event of retirement on 01/10/2028, i.e. 3 months after the full rate, he needs 63 days of Long Term TSA to cover the period from 01/07/2028 to 30/09/2028 (we consider working days only), which means that only 137 days of Long Term TSA (200 - 63) benefit from the contribution, which represents in this case 45 days (137 * 1/3).

--When the days on the Long Term TSA are used during the career, to take a break (between 1.5 and 6 months), there is no contribution.

How to feed the TSA?

Concerning the Long Term TSA, we refer you to our latest issue of "FOCUS on... the feeding of the Long Term TSA"

Here is also in visual form the different possibilities of feeding the TSA: